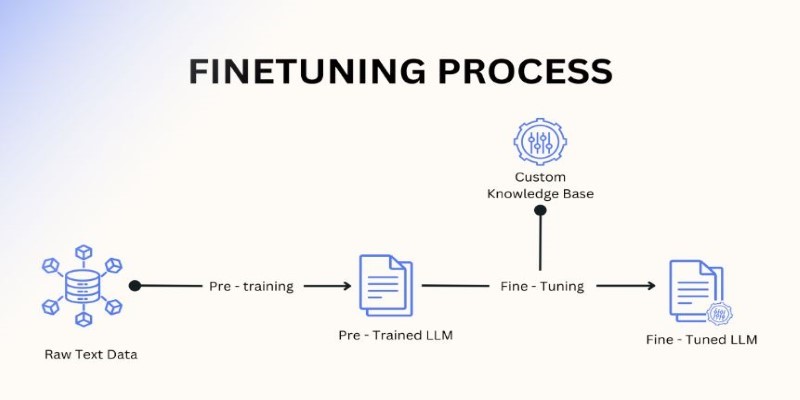

Financial success isn’t just about big moves—it’s about the small adjustments that keep everything running smoothly. Fine-tuning is the quiet force behind smart financial decisions, whether it’s tweaking an investment portfolio, adjusting business strategies, or refining personal budgets. Markets shift, economies evolve, and what worked yesterday might not work tomorrow. That’s why fine-tuning matters—it helps adapt to change without overreacting.

Think of it like steering a ship; minor course corrections prevent major detours. In finance, such small, deliberate adjustments compound the difference between stability and unpredictability. Let's dissect how fine-tuning maintains finances on point and strategies effective.

Understanding Fine-Tuning in Finance

Fine-tuning is especially crucial in volatile markets. Because economic realities, consumer patterns, and business environments are perpetually evolving, financial plans need to adapt. What was effective a year ago might not be effective today, and making slight tweaks can keep a business competitive or prevent unnecessary losses.

A company may refine its pricing strategy to maximize revenue without antagonizing customers. An investor can modify the mix of assets in their portfolio to accommodate shifting economic realities. Governments and central banks refine monetary policy to achieve equilibrium between inflation and growth. In each of these instances, the objective is the same: to realize optimal financial results with minimal dislocation.

One of the most significant strengths of fine-tuning is that it permits preemptive money handling. Rather than allowing problems to happen first, individuals and businesses can initiate modest changes that prevent their fiscal planning from veering off course. Below are examples of how fine-tuning pertains to various financial segments:

Key Areas Where Fine-Tuning Matters

One of the most significant strengths of fine-tuning is that it permits preemptive money handling. Rather than allowing problems to happen first, individuals and businesses can initiate modest changes that prevent their fiscal planning from veering off course. Here's how fine-tuning applies to different financial areas:

Investment Portfolios

Market fluctuations can shift the balance of an investment portfolio, increasing risk exposure. Fine-tuning ensures a stable asset mix by periodically adjusting stocks, bonds, and other investments. This process, called rebalancing, realigns investments with financial goals and risk tolerance. For example, if stock values rise, turning a 60/40 stock-bond split into 70/30, selling some stocks, and buying more bonds restores the balance. These small, calculated adjustments protect against downturns while maintaining long-term growth potential.

Business Strategy and Pricing Adjustments

Businesses must fine-tune strategies to remain competitive. Adjusting pricing, optimizing supply chains, and refining marketing campaigns help sustain profitability. Small changes, like slightly raising prices to counter inflation while offering discounts to loyal customers, ensure steady revenue without losing market share. A well-calibrated business strategy prevents financial struggles and enhances customer retention. Companies that continuously refine their operations can navigate changing market conditions effectively, maintaining profitability and long-term stability in an evolving economy.

Monetary and Fiscal Policies

Governments and central banks fine-tune financial policies to ensure economic stability. Adjustments to interest rates, taxation, and government spending help control inflation and encourage growth. If inflation rises, increasing interest rates slows borrowing and spending, preventing overheating. Conversely, in economic slowdowns, small rate cuts stimulate growth without causing excessive inflation. These incremental policy adjustments help balance economic expansion and contraction, ensuring long-term financial stability without triggering drastic market fluctuations or unnecessary economic disruptions.

Personal Financial Planning

Individuals benefit from fine-tuning their financial plans to adapt to life changes. Adjusting budgets for inflation, increasing retirement contributions after a raise, or refinancing a mortgage for better rates can improve financial stability. For example, a salary increase might allow someone to allocate more funds toward investments or savings. These small, intentional financial adjustments ensure long-term security, prevent financial strain and help individuals achieve financial goals with minimal risk while maximizing growth opportunities.

The Challenges of Fine-Tuning

While fine-tuning is an effective strategy, it comes with its own set of challenges. One major difficulty is the temptation to over-adjust. Making too many small changes too frequently can lead to instability and missed opportunities. A stock investor who constantly tweaks their portfolio may end up chasing short-term trends instead of focusing on long-term gains.

Another challenge is the need for accurate data. Effective fine-tuning relies on real-time financial information. Without accurate insights, adjustments may be based on outdated or incomplete data, leading to ineffective or even counterproductive changes.

Additionally, external factors such as sudden economic downturns, regulatory changes, or global events can disrupt even the best fine-tuning strategies. While small adjustments can help manage risk, they cannot eliminate uncertainty.

The Long-Term Impact of Financial Fine-Tuning

Fine-tuning is a continuous process. Unlike major overhauls that happen occasionally, small refinements occur regularly to maintain financial health and stability. The long-term benefits of fine-tuning include:

- Improved efficiency – Adjusting financial strategies based on current data helps optimize performance.

- Reduced risk – Small adjustments help prevent significant losses caused by outdated or rigid financial plans.

- Greater financial stability – Regular refinements ensure that businesses, individuals, and governments remain financially resilient in changing conditions.

- Sustained growth – Rather than relying on short-term gains, fine-tuning supports steady and sustainable financial success.

For example, an investor who fine-tunes their portfolio by gradually shifting toward more conservative investments as they approach retirement is likely to experience more stability than someone who waits for a financial crisis to make abrupt changes.

Similarly, a company that continuously evaluates and adjusts its business strategy is more likely to thrive than one that waits until profitability declines to take action. The ability to adapt in small ways over time is what makes fine-tuning such a powerful financial tool.

Conclusion

Fine-tuning isn't about dramatic overhauls—it's about making small, strategic adjustments that keep finances on track. Whether refining investments, tweaking business strategies, or adjusting policies, these minor shifts create long-term stability and growth. The key is balance—adjust too often, and you risk instability; ignore it, and opportunities slip away. In a constantly changing financial landscape, fine-tuning ensures adaptability without chaos. It’s the difference between reacting to problems and proactively shaping a secure, optimized financial future.